Perhaps you’re an investor looking to diversify your portfolio, or want to expand your understanding of residential real estate to the commercial sector. Or, maybe you’re new to investing, but have noticed that commercial real estate (CRE) has some of the highest returns and cash flow available. It’s also possible that crowdfunding, which lowers financial barriers to CRE investing, has caught your attention.

No matter what drew you to CRE, welcome. Pioneer Realty Capital is here to untangle some of the confusion that new investors may experience, and support them on their journey to financial security and success. Whatever your wealth-building goals, we’re sure you’ll find something here that helps.

Ready to see your roadmap to CRE investing success? Read on.

Step One: Understand the Basics

If it were easy, everybody would be doing it. The popular saying applies to just about everything worth doing, including CRE investing. Before committing hard-earned money to CRE investing, it’s important to understand how everything works, and where your goals fit in.

First of all, when it comes to CRE investing, money comes from two places: rental income, and property appreciation. Rental income is what tenants, often business owners, pay the property owner (that’s you!) as part of a lease agreement. This income is what provides the much-sought cash flow CRE investors enjoy, and is much more stable and liquid than other investments, like stocks.

Property appreciation, on the other hand, is less liquid; it’s simply the rise in property value over time. Since space is a finite resource in any given location, real estate has inherent value. As space gets used up, properties tend to become more valuable over time. Some investors also raise the value of their properties by upgrading them for value-add. While property value is generally harder to “cash in” (you’d have to sell it), it is very useful as a leveraging tool for further investments and wealth-building.

Additionally, you’ll want to familiarize yourself with the different types of CRE properties, such as office, retail, industrial, multifamily, mixed-use, or special purpose. If you already have some experience in one of these sectors, that may help narrow down the type of property you look into for the next steps. If you’re a business owner who plans to use the property yourself, familiarize yourself with owner-occupied CRE strategies.

Step Two: Do Your Homework

You’ll hear investors talk a lot about due diligence, and for good reason. Due diligence means researching how investing works, how the CRE market and its cycles operate, and how it differs from residential real estate.

Importantly, commercial real estate focuses more heavily on things like usable square footage, longer leases, and tenant types as compared to residential real estate. As you research and narrow down property types and locations, you’ll want to become a master in your areas of interest. Familiarize yourself with current deals and sellers, and note which ones look right for your goals.

The benefits of all this work return in multiple: CRE investors experience a higher income, less competition, and less volatility than most other investors. Commercial real estate investment also comes with tax benefits in addition to securing future wealth and diversifying portfolios. A little work up front goes a long way for years to come.

Step Three: Prepare for Paperwork

Once you’ve become a near-expert on your ideal investment property, you’ll obviously need to prepare for the documentation that comes with financing and purchasing.

To do this, gather your contact information and a description of your business or entity, if you have either. If you own a business, you’ll also want to write up a description of your core services. All of this will help establish credibility with lenders and partners. In today’s technology age, this packet should be created electronically so it can be easily tailored to different purposes.

By this point, you’ve probably guessed that your credit score and other financial standings will factor into the kinds of deals you’re able to participate in. Do everything you can to establish strong creditworthiness while doing your research on loan to value and debt service coverage ratios, in particular if you plan to borrow as part of your investment strategy.

There are many terms and trends to familiarize yourself with at this stage, such as amortization, cash on cash, internal rate of return, CAP rate, and net operating income. You’ll also want to create contingency and capital reserve funds. If it all seems like a lot, it may be wise to look into partnering with a financial advisor before dipping into CRE investment. This brings us to our final step.

Step Four: Find a Property, and/or a Partner

At this stage, investors are ready to start really narrowing down properties they’re interested in. They may find these properties via marketing tactics like direct mail, searching increasingly available online listings, or networking with other investors or financial advisors. If you’re purchasing on your own, you’ll need to think about whether you need asset management and start planning to hire a property manager and maintenance team.

For many investors at this stage, the amount of capital available plays a large role in investment options. Traditionally, hundreds of thousands of dollars were needed to even consider CRE investing. Now, thanks to crowdfunding, some platforms welcome investors with as little as $500. These platforms also remove much of the work of identifying and negotiating property deals on your own. In fact, partnering with experienced investment strategists is a wise move for most beginners to CRE investing.

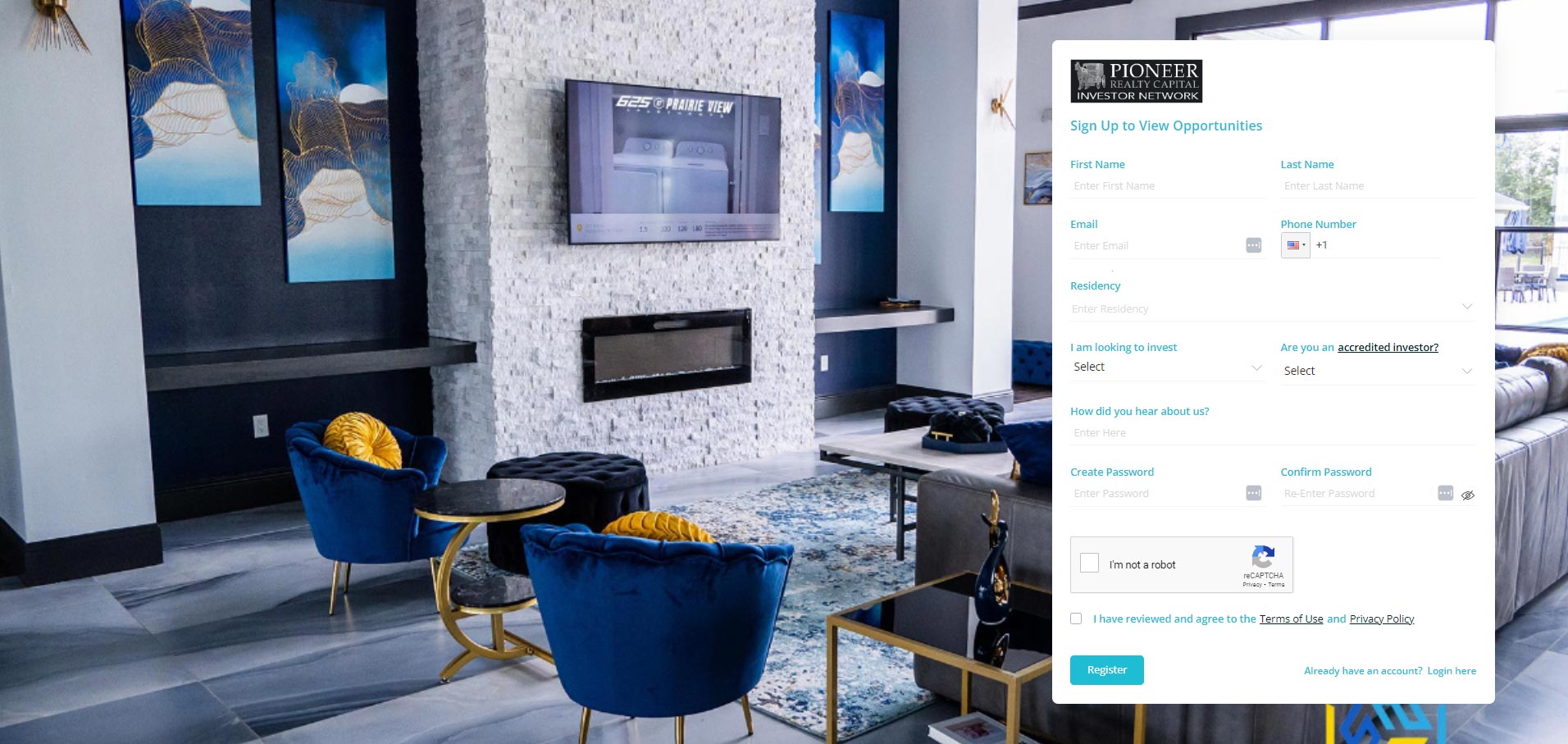

Partners like PRC can help you avoid mistakes like falling for improper valuations or missing a crucial part of due diligence. They can also help you get a loan tailored to your situation, be it an SBA loan for your small business, or a more conventional or commercial bridge loan. Any questions you may have along the way are easily answered by the experienced professionals at your side. For accredited investors, we created the PRC Investor Network.

Commercial Real Estate Investing: Many Moving Parts

As you can see, commercial real estate investment involves quite a bit of research and consideration. However, the payoff is well worth the work. While setbacks and extended timelines will almost certainly happen along the way, some of this strain can be alleviated with a partner like Pioneer Realty Capital, and by becoming a PRC Network Investor. Our investors are making a real positive impact on their communities. The PRC Investor Network invests in institutional-grade commercial real estate like multifamily and others. These investments have had some of the highest returns and cash flow available. When you’re ready, reach out to our Investor Relations Manager J.C. Shelley at 817-285-2542, and sign up to view all our current offerings.

CONNECT