There are many reasons to be interested in passive real estate investment. Regular dividends or fixed payments from borrowers, for example, provide a predictable stream of passive income and a level of financial stability that can be hard to match.

Some investors set even loftier goals. Passive real estate investment can lead to portfolio growth through property appreciation. What’s more, property ownership is one of the surest ways to secure generational wealth for one’s family. Combined with passive income, this growth potential makes passive real estate investment a preferred choice for many savvy investors.

We’ve already covered the basics of investing in commercial real estate in the past. In order to begin earning passive income through real estate investment, however, you’ll need to understand what it is and how it works. In this post, we’ll provide an introduction to passive investing and share how you can get started today.

What Qualifies as Passive Real Estate Investing?

Buying and renting out a property typically isn’t considered passive real estate investment. If you manage maintenance and leases yourself, that’s far from passive! However, some people find that paying a property manager (or property management company) takes much of the work out of this endeavor and feels passive enough.

If you don’t mind the work that goes into identifying, hiring, communicating, and negotiating terms with a property manager, this could be a form of mostly-passive income that works for you. Many investors who go this route also employ a “buy and hold” technique, renting the property out while waiting for its value to appreciate enough to make a significant profit by selling.

Appreciation is when the value of a property increases over time. Keep this in mind for when we delve into its advantages further down.

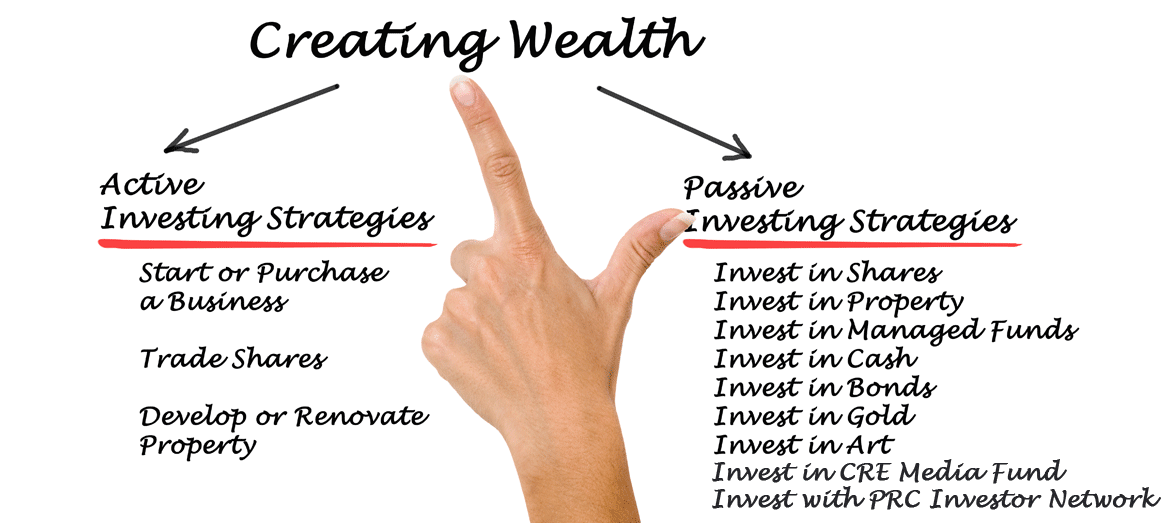

Buying and renting is a popular real estate investment choice. However, most truly passive real estate investors seek investments that grant partial property ownership in exchange for capital, then pay out dividends or other types of regular income.

Some examples of this type of passive real estate investment include stocks, mutual funds, or partnerships with investment companies. It’s passive because after your initial investment, you do little to no work and have no hands-on responsibilities with regards to an actual property.

How Does Passive Real Estate Investing Work?

For a more hands-off approach, you may invest in real estate development companies, brokers, construction companies, or REITs. Alternately, you may partner with other investors or companies, or work with a syndicator. Crowdfunding is also a new option that has made passive real estate investment more accessible than ever before, with lower buy-in for direct investments in individual real estate deals.

Debt-based investments tend to pay fixed monthly payments over time, creating an excellent source of passive income. Others grant an equity stake in ongoing revenue and/or profit, which may grant generous returns when that income is distributed to investors.

What Are the Advantages of Passive Real Estate Investment?

One of the reasons why passive real estate investment is such a smart move is the associated tax benefits. Property ownership comes with tax deferrals that let you keep more of your earnings. We delve more deeply into the details on our previous post about tax benefits, and highlight how to avoid capital gains tax in our post about opportunity zones.

With the right partner, there’s also no need to worry about maintenance, tenants, or even working with banks. Your real estate investment company will do that all for you. Paired with tax benefits, this generally positions real estate investing as the most return a person can get with the least effort.

Then, there’s appreciation. Property values tend to rise over time, meaning that real estate will increase your portfolio value to hedge against inflation. This can also generate leverage for future investments, or provide a profitable opportunity to sell down the line.

Finally, real estate adds diversification to your portfolio, building resilience against uncertainty.

If you choose to go the REIT or stock route, all of the above still applies, though with less tax benefits. You can be taxed at the highest tax bracket of your regular income if you choose these other investment options. Invest directly in properties for maximum returns.

Why Not Start Today?

As with any investment, passive real estate investing means accepting a certain level of risk. To mitigate this, do your own research and consider tapping into financial experts such as the ones here at Pioneer Realty Capital. We have over 20 years in commercial mortgages, development, and investments, and we have never lost an investor money. Over $2B funded nationwide, and we stick by our strong commitment to investor customer service and success. Sign up on our network of accredited investors today, and check out our current passive income real estate investment opportunities. We offer self-directed IRA, direct investment via ach payment form, and many other funding options to make passive investment even easier for you.

CONNECT